Schedule D (Form 990) is a critical supplement for tax-exempt organizations, detailing financial specifics on donor-advised funds, conservation easements, and other key assets, ensuring transparency and compliance.

1.1 Purpose of Schedule D

Schedule D (Form 990) serves to provide detailed financial disclosures for tax-exempt organizations, focusing on donor-advised funds, conservation easements, art collections, and other significant assets. Its purpose is to enhance transparency, ensure compliance with IRS regulations, and offer a comprehensive overview of an organization’s financial activities and management practices.

1.2 Overview of Form 990 and Its Schedules

Form 990 is the annual information return for tax-exempt organizations, detailing financial activities, governance, and compliance. Its schedules, including Schedule D, provide supplementary information. Schedule D specifically addresses donor-advised funds, conservation easements, and other financial details, ensuring transparency and adherence to IRS regulations for nonprofit organizations.

Filing Requirements for Schedule D

Organizations must file Schedule D if they answered “Yes” to any of Form 990, Part IV, lines 6-12a, or for specific disclosures under line 12b.

2.1 Who Must File Schedule D?

Organizations must file Schedule D if they answered “Yes” to any of Form 990, Part IV, lines 6-12a, or for specific disclosures under line 12b. This includes nonprofits managing donor-advised funds, holding conservation easements, or maintaining certain financial arrangements. All Section 501(c)(3) organizations filing Form 990 are required to complete and attach Schedule D if applicable, ensuring compliance with IRS reporting standards.

2.2 Triggers for Filing Schedule D (Form 990, Part IV, Lines 6-12)

Organizations must file Schedule D if they answered “Yes” to any of Form 990, Part IV, lines 6-12a. These triggers include maintaining donor-advised funds, holding conservation easements, or managing certain financial arrangements like escrow accounts. Additionally, a “Yes” on line 12b allows completion of Parts XI and XII, though it isn’t mandatory. This ensures proper reporting of specific financial activities and assets.

Key Components of Schedule D

Schedule D covers donor-advised funds, conservation easements, art collections, escrow accounts, and endowment funds, ensuring detailed reporting of these financial components for transparency and compliance.

3.1 Donor-Advised Funds

Detailed reporting on donor-advised funds is required in Schedule D, including total contributions, grants distributed, and administrative fees. Organizations must disclose policies on fund usage and ensure compliance with IRS guidelines to prevent abusive practices, such as improper benefits to donors or excessive management fees, maintaining transparency and accountability in charitable operations.

3.2 Conservation Easements

Conservation easements must be reported in Schedule D, Part II, detailing the number, purpose, and acreage of easements held. Organizations must ensure easements serve a conservation purpose and comply with IRS regulations, avoiding improper benefits or excessive fees, while maintaining transparency in their stewardship and reporting responsibilities for these environmentally significant holdings.

3.3 Art and Museum Collections

Organizations must report art and museum collections on Schedule D, disclosing their value, method of valuation, and public accessibility. This ensures compliance with IRS regulations and transparency in managing these cultural assets, while avoiding improper use or private benefit, maintaining accountability for their preservation and public access as part of the organization’s charitable mission and financial oversight.

3.4 Escrow or Custodial Accounts

Escrow or custodial accounts held by an organization must be reported on Schedule D, detailing their purpose, balances, and terms. This ensures transparency and compliance, as these accounts often hold funds restricted for specific uses. Proper disclosure helps prevent misuse and ensures accountability, aligning with IRS requirements for financial reporting and avoiding potential violations of tax-exempt standards.

3.5 Endowment Funds

Endowment funds are reported on Schedule D to provide transparency into their management and use. Organizations must disclose the purpose, balances, and any restrictions on these funds. This reporting ensures compliance with IRS requirements and demonstrates accountability, as endowment funds are crucial for an organization’s long-term financial health and charitable mission. Accurate disclosure helps maintain public trust and regulatory compliance.

Completing Schedule D

Completing Schedule D requires detailing financial specifics on donor-advised funds, conservation easements, and other assets, ensuring transparency and compliance with IRS reporting requirements for tax-exempt organizations.

4.1 Gathering Required Financial Data

Gathering accurate financial data is essential for completing Schedule D. Organizations must compile detailed information on donor-advised funds, conservation easements, art collections, escrow accounts, and endowment funds. Review financial statements, ensuring all figures align with IRS guidelines. Verify asset valuations, transaction records, and compliance with specific reporting requirements. Consulting with financial professionals can help ensure accuracy and adherence to IRS definitions and instructions for each category.

4.2 Step-by-Step Instructions for Each Section

Complete each section of Schedule D by following IRS guidelines. Start with Part I for donor-advised funds, detailing contributions and distributions. For conservation easements in Part II, report easement values and monitoring efforts. In Part III, document art and museum collections with appraisals. Parts IV and V cover escrow accounts and endowment funds, requiring precise financial data. Attach required statements and ensure compliance with IRS definitions and reporting standards.

Supplemental Financial Information

Schedule D requires detailed reporting on endowment funds, uncertain tax positions, and other financial disclosures, ensuring transparency and accountability in an organization’s financial operations and compliance with IRS standards;

5.1 Reporting Endowment Funds

Organizations must report endowment funds on Schedule D, including their purposes, donor restrictions, and financial data. This ensures transparency and compliance, detailing how funds are managed and used, aligning with IRS requirements for tax-exempt entities. Accurate reporting of endowment funds is essential for maintaining public trust and demonstrating fiscal accountability. Proper disclosure helps avoid compliance issues and ensures clarity in financial operations.

5.2 Disclosures for Uncertain Tax Positions

Organizations must disclose uncertain tax positions in Schedule D, providing details on potential liabilities. This includes describing the nature of the uncertainty and the range of possible tax impacts. These disclosures, often derived from financial statement footnotes, ensure transparency and compliance with IRS requirements, helping to avoid disputes and ensuring accurate reporting of tax-related risks.

Instructions for Schedule D

Find detailed IRS guidelines for completing Schedule D in the official instructions, ensuring compliance with reporting requirements for donor-advised funds, conservation easements, and other financial disclosures.

6.1 IRS Guidelines and Definitions

The IRS provides detailed guidelines and definitions in the instructions for Schedule D (Form 990) to ensure accurate reporting of donor-advised funds, conservation easements, and other financial disclosures. These guidelines clarify terms, specify reporting thresholds, and outline required documentation, helping organizations comply with regulatory requirements effectively.

6.2 Accessing the Form and Instructions

Schedule D (Form 990) and its instructions can be accessed on the IRS website at IRS.gov. Organizations can download the form and instructions as PDFs or access them through tax preparation software. For desktop software users, Schedule D can be found by searching “Sch D” in the forms library, ensuring easy access for accurate filing and compliance.

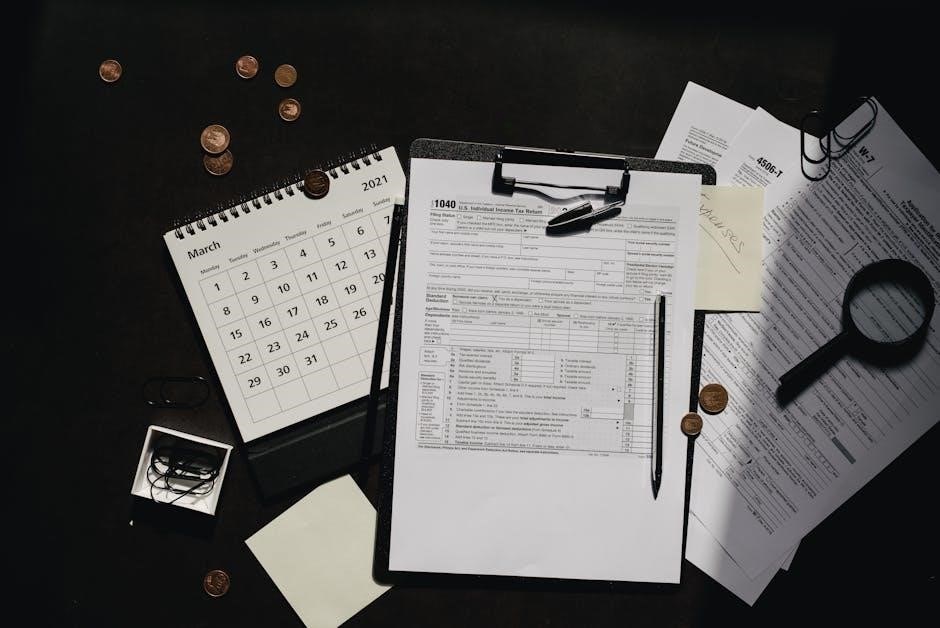

Filing Schedule D

Schedule D must be filed electronically through the IRS website or mailed to the designated address for Form 990 submissions, ensuring proper attachment to the main form.

7.1 Electronic Filing Options

Electronic filing of Schedule D is mandatory for most tax-exempt organizations. The IRS requires filing through authorized e-file providers or using tax software like Tax990. Ensure the software supports Schedule D and is IRS-approved. Attach Schedule D to Form 990 electronically, following the IRS guidelines. Organizations can also use the IRS’s Modernized e-File platform for secure submissions. Verify requirements and file timely to avoid penalties.

7.2 Mailing Instructions

When filing Schedule D by mail, ensure it is securely attached to Form 990 and sent to the IRS address designated for your organization’s location. Use first-class mail or a reputable carrier for tracking. Include a cover letter with contact information for any queries. Verify the correct IRS mailing address to prevent delays. Timely filing is crucial to avoid penalties and ensure compliance with IRS regulations.

Common Mistakes to Avoid

Common mistakes include incomplete reporting of donor-advised funds, conservation easements, and failing to disclose uncertain tax positions, leading to compliance issues and potential IRS scrutiny.

8.1 Incomplete or Missing Information

One common mistake is submitting Schedule D with incomplete or missing details, such as failing to report donor-advised funds or conservation easements fully. This can lead to delays in processing or compliance issues. Ensure all required sections are filled accurately, including financial data and disclosures for uncertain tax positions. Double-check each part before submission to avoid errors and maintain compliance with IRS regulations.

8.2 Noncompliance with Reporting Requirements

Noncompliance with Schedule D reporting requirements can result in penalties and legal consequences. Inaccurate or omitted disclosures, such as failing to report donor-advised funds or conservation easements properly, may lead to IRS scrutiny. Organizations must adhere to all defined guidelines to maintain tax-exempt status and avoid potential fines or reputational damage, ensuring full transparency in their financial disclosures. Compliance is essential to uphold regulatory standards.

Best Practices for Compliance

Thoroughly review Schedule D before submission, ensuring accuracy and completeness. Engage professional advisors for complex disclosures and maintain detailed documentation to support all reported financial information and activities.

9.1 Reviewing the Form Before Submission

Conduct a thorough review of Schedule D to ensure accuracy and compliance. Verify all financial data, disclosures, and attachments. Pay attention to details in donor-advised funds, conservation easements, and other reported assets. Ensure all questions are answered correctly and no sections are incomplete. Consider involving a professional to spot errors and confirm adherence to IRS guidelines before final submission.

9.2 Consulting Professional Advisors

Engaging tax professionals or legal advisors is crucial for ensuring accurate completion of Schedule D. They provide expertise in interpreting complex IRS requirements, particularly for donor-advised funds, conservation easements, and uncertain tax positions. Advisors can help identify potential errors, ensure compliance, and offer insights into best practices for reporting financial data and disclosures, ultimately safeguarding the organization’s reputation and tax-exempt status.

Schedule D is essential for ensuring transparency and compliance in nonprofit financial reporting, providing detailed insights into key assets and supporting the organization’s integrity and public trust.

10.1 Importance of Schedule D in Nonprofit Transparency

Schedule D enhances nonprofit transparency by requiring detailed disclosures on donor-advised funds, conservation easements, and financial assets. This ensures accountability, fosters trust, and aligns with the IRS’s goal of promoting integrity and public confidence in tax-exempt organizations.

Future Updates and Changes

The IRS periodically updates Schedule D instructions to enhance clarity and compliance, ensuring alignment with evolving tax regulations and nonprofit reporting standards.

11.1 Recent Revisions to Schedule D Instructions

The IRS has updated Schedule D instructions to clarify reporting requirements for donor-advised funds, conservation easements, and uncertain tax positions. Changes include new definitions for endowment funds and expanded disclosures. Organizations must now report additional details on escrow accounts and custodial arrangements. The revised instructions also introduce new lines for supplemental financial information, ensuring better transparency and compliance with evolving tax regulations.

11.2 Staying Informed About IRS Updates

To stay informed about IRS updates, organizations should regularly visit the IRS website and subscribe to newsletters. Checking the IRS Bulletin and specific pages for exempt organizations is crucial. Additionally, attending IRS-sponsored webinars and reviewing updated instructions for Schedule D ensures compliance. Professional associations and tax advisors often provide summaries of key changes, helping nonprofits navigate evolving requirements efficiently.